Crypto expertise in WEALTH MANAGEMENT.

Distribution of investment solutions related to Blockchains and Cryptoassets - B2B2C - Wealth Management Firms, Independent Asset Managers & Family Offices

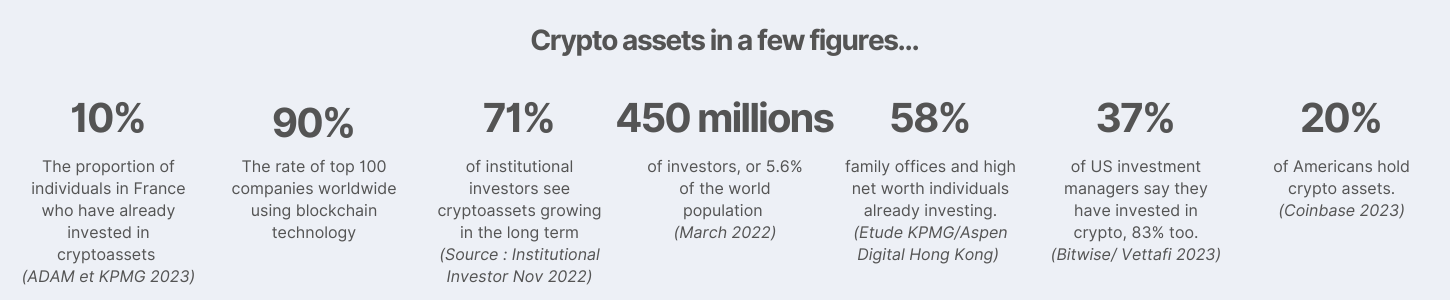

Crypto assets in a few figures...

10%

90%

71%

450 millions

58%

37%

20%

Standardised & regulated offers

Broad range of investment solutions

Alpin capital offers access to leading solutions and themes.

Profiled discretionary management, private equity, defi, algorithmic trading, thematic funds, ISIN funds in life insurance, AMC...

A service with no extra costs

We provide you with a subscription and monitoring platform as well as personalised support from one of our managers partnerships without impacting your remuneration !

Our clients testimonials

Benjamin BERTRAND, Groupe SYNALP

At the firm, we have always been convinced of the interest and usefulness of blockchain technology. However, as adoption and client demand is still relatively low, we did not want to devote.

However, as client adoption and demand is still relatively low, we did not want to devote time or staff to this still young asset class, even if it meant not offering anything.

With Alpin Capital we benefit from a support and tools that allow us to meet the expectations of our clients the most adventurous clients !

Make an appointment with an EXPERT CONSULTANT.

Investing in cryptoassets is a real opportunity...

If you are an investor, we can help you with your diversification strategy.

Copyright © 2024 Alpin Capital. All rights reserved.

Alpin Capital is a limited liability company under French law with its registered office at 90 allée des érables, 73420 DRUMETTAZ-CLARAFOND, France. Its capital is 400 000,00 € and its RCS number is 913 729 042. Alpin Capital is owned by Alpin Capital Group, a public limited company with a capital of € 3,565,800.00, RCS number 922 537 626. The investment solutions presented are intended for sophisticated investors and should not represent more than 10% of a client's financial assets.